south carolina limited liability company act

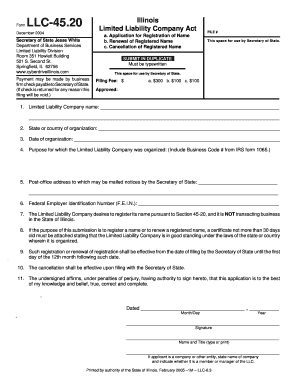

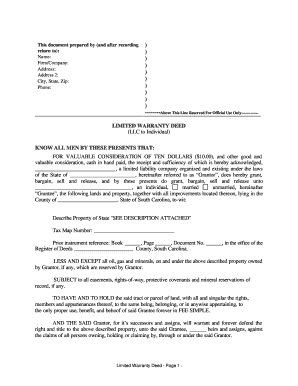

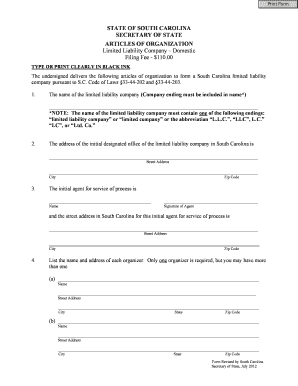

Websouth carolina limited liability company act support@ijwireless.us sales@ijwireless.us chalmette fireworks show 2022 south carolina limited liability company act offroad outlaws unblocked SECTION 4.8 Indemnification of Managers. Section 33-44-1004 - Issuance of certificate of authority. any Member remains to carry on the business of the Company. Manager may admit additional Members from time to time upon terms and conditions determined by the Member. Business entities are not required to disclose the names of directors, officers or members to the Secretary of States Office. (ii) specify the number or percentage of members or disinterested managers that may authorize or ratify, after full disclosure of all material facts, a specific act or transaction that otherwise would violate the duty of loyalty; (3) unreasonably reduce the duty of care under Section 33-44-409(c) or 33-44-603(b)(3); (4) eliminate the obligation of good faith and fair dealing under Section 33-44-409(d), but the operating agreement may determine the standards by which the performance of the obligation is to be measured, if the standards are not manifestly unreasonable; (5) vary the right to expel a member in an event specified in Section 33-44-601(6); (6) vary the requirement to wind up the limited liability company's business in a case specified in Section 33-44-801(3) or (4); or. All withdrawals shall be made, subject to SECTION 4.2 Number, Tenure and Qualifications of Managers. Section 33-44-804. We took the liberty of doing a little legwork in helping to answer the above questions. (7) whether one or more of the members of the company are to be liable for its debts and obligations under Section 33-44-303(c). SECTION 4.5 Officers. To learn more about how we use cookies, please see our, Support and Empowerment of Diverse Attorneys, Diversity Scholarship & Fellowship Programs. The name of the business entity is not available for use in South Carolina. As to all other matters, if any provision of an operating agreement is inconsistent with the articles of organization: (1) the operating agreement controls as to managers, members, and members' transferees; and. President, the Managers or the Member. You can explore additional available newsletters here. SECTION 3.1 Initial Contributions and Interest. There is no record on file related to the entity for which the document was requested. Company shall be identified as a limited liability company. [4{E5|R*FPM@xDhII;s` ^3My82UL,8.vWo~i}&wZ`cPf3,T8V#3tIL`U?+ c

9meJ(P~.IV1O1;iqNy+R{V W(8r5:rWo'6uUvs<=n'I@29,? A religious nonprofit is organized primarily or exclusively for religious purposes. All ratings are determined solely by our editorial team. Section 33-44-104 - Supplemental principles of law. Section 33-44-501 - Member's distributional interest.  11)Does the Secretary of States Office regulate Homeowners Associations? Section 33-44-1001 - Law governing foreign limited liability companies. Toni Matthews-El is a writer and journalist based in Delaware. For applications by foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. Most businesses are legally obligated to get an EIN. negligence, willful misconduct, or fraud; provided, that the satisfaction of any indemnification and any holding harmless shall be from and limited to Company assets and the Member shall not have any personal liability on account thereof. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. For this information, please contact the Department of Revenue at (844) 898-8542. 5174) ..44. Section 33-44-802 - Limited liability company continues after dissolution. WebSouth Carolina Limited Liability Companies and Limited Liability Partnerships Fourth Edition TABLE OF CONTENTS Chapter 1 Overview of the South Carolina Uniform Limited In addition, the South Carolina Secretary of States website is a great resource for information about the entire registration process and any additional obligations. For foreign entities, is there a different set of forms and fees. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. The default rules governing LLCs are found in the South Carolina Uniform Limited Liability Company Act of 1996, S.C. CODE ANN. A certificate of no record was requested for an entity that is already on file with the Secretary of States Office. CHAPTER If the nonprofit is not a charitable organization, the Secretary of State has no authority to investigate the nonprofit. To the extent the operating agreement does not otherwise provide, this chapter governs relations among the members, managers, and company. If you want to learn how to set up an LLC in South Carolina, our simple guide will help you get started right away. A CL-1 form is a Department of Revenue form filed with the Secretary of State along with the Articles of Incorporation for all business corporationsand nonprofit corporations formed aspolitical associations. Universal Citation: SC Code 33-44-105 (2012) (a) The name of a limited liability The fee is $25, and you are required to submit two copies of the form. Act. (a) The Company shall provide to the Registered Agent Search, SC Secretary of State's Office By default, members of an LLC pay taxes as a share of personal income just as owners of a sole proprietorship or general partnership wouldthis is often referred to as a pass-through tax structure. Section 33-44-102 - Knowledge and notice. WebNonprofit corporations and Limited Liability Companies must file for reinstatement within two years of the date of the administrative dissolution. ;e When completing physical documents, you must hand over two completed copies. No. Where the context so requires, the masculine shall That said, be sure to check for changes to the law from time to time, as South Carolina could update its requirements concerning LLCs. Be sure to include a self-addressed and stamped return envelope. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. A South Carolina Limited Stafford Act, as Amended, and Related Authorities - FEMA. Agreement shall mean this Operating Agreement as amended from time to time. South Carolina LLC Statutes-Defining an LLC The formation and regulation of LLCs are governed by the South Carolina Uniform Limited Liability Company Act of 1996 (the Act). Section 33-44-210 - Filing by judicial act. All Rights Reserved. SC Secretary of State's Office Incorporators and organizers of business entities cannot be added or removed. 0000005261 00000 n

Columbia, SC 29201, The Official Web Site of the State of South Carolina, High Growth Small Business Job Creation Act, Charities, Professional Fundraisers and Solicitors, and Raffles, South Carolina Department of Consumer Affairs, South Carolina Homeowners Association Act, South Carolina Department of Labor, Licensing and Regulation, South Carolina Association of Counties Website, Business Entities Online Document Request. The President shall be the chief executive officer of the Company and, as such, shall, subject to the control of the Managers and Member, supervise the management of the Company. The principal office of the Company shall be at 4001 Rodney Parham Road, Little Rock, Arkansas 72212, or such other place as the Managers shall designate. Company shall refer to the limited liability company created under this Agreement and the Certificate. provision, term, or condition itself or of any of the other provisions, terms, or conditions hereof or bar its enforcement at any time thereafter. By registering a domain and setting up social media accounts now, youll be assured of having the right website and social media names when youre ready to start your marketing efforts. Act shall mean the South Carolina Limited Liability Company In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Section 33-44-402 - Member's liability for contributions. Please note, the Secretary of States Office does not have the names or addresses of a companys officers or directors. The Company shall be dissolved upon the happening of any of the following events, whichever shall first occur: (a) upon the written direction of the Member; or. Section 33-44-302 - Limited liability company liable for member's or manager's actionable conduct. Section 33-44-407 - Liability for unlawful distributions. Section 33-44-405 - Sharing of and right to distributions. Corporations are not required to submit the names of stockholders to the Secretary of States Office. trailer

Additional Contributions; Interest. Section 33-44-408 - Member's right to information. terms and provisions of this Agreement, the Managers shall have exclusive management and control of the affairs of the Company and shall have the power and authority to do all things necessary or appropriate to carry out the purposes of the Company. Section 33-44-1206 - Transitional provisions. respect to the Company and the Companys assets and property. As for the $110 fee, make your check or money order payable to the South Carolina Secretary of State. the Company. By clicking "Accept," you agree to our use of cookies. An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.

11)Does the Secretary of States Office regulate Homeowners Associations? Section 33-44-1001 - Law governing foreign limited liability companies. Toni Matthews-El is a writer and journalist based in Delaware. For applications by foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. Most businesses are legally obligated to get an EIN. negligence, willful misconduct, or fraud; provided, that the satisfaction of any indemnification and any holding harmless shall be from and limited to Company assets and the Member shall not have any personal liability on account thereof. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. For this information, please contact the Department of Revenue at (844) 898-8542. 5174) ..44. Section 33-44-802 - Limited liability company continues after dissolution. WebSouth Carolina Limited Liability Companies and Limited Liability Partnerships Fourth Edition TABLE OF CONTENTS Chapter 1 Overview of the South Carolina Uniform Limited In addition, the South Carolina Secretary of States website is a great resource for information about the entire registration process and any additional obligations. For foreign entities, is there a different set of forms and fees. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. The default rules governing LLCs are found in the South Carolina Uniform Limited Liability Company Act of 1996, S.C. CODE ANN. A certificate of no record was requested for an entity that is already on file with the Secretary of States Office. CHAPTER If the nonprofit is not a charitable organization, the Secretary of State has no authority to investigate the nonprofit. To the extent the operating agreement does not otherwise provide, this chapter governs relations among the members, managers, and company. If you want to learn how to set up an LLC in South Carolina, our simple guide will help you get started right away. A CL-1 form is a Department of Revenue form filed with the Secretary of State along with the Articles of Incorporation for all business corporationsand nonprofit corporations formed aspolitical associations. Universal Citation: SC Code 33-44-105 (2012) (a) The name of a limited liability The fee is $25, and you are required to submit two copies of the form. Act. (a) The Company shall provide to the Registered Agent Search, SC Secretary of State's Office By default, members of an LLC pay taxes as a share of personal income just as owners of a sole proprietorship or general partnership wouldthis is often referred to as a pass-through tax structure. Section 33-44-102 - Knowledge and notice. WebNonprofit corporations and Limited Liability Companies must file for reinstatement within two years of the date of the administrative dissolution. ;e When completing physical documents, you must hand over two completed copies. No. Where the context so requires, the masculine shall That said, be sure to check for changes to the law from time to time, as South Carolina could update its requirements concerning LLCs. Be sure to include a self-addressed and stamped return envelope. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. A South Carolina Limited Stafford Act, as Amended, and Related Authorities - FEMA. Agreement shall mean this Operating Agreement as amended from time to time. South Carolina LLC Statutes-Defining an LLC The formation and regulation of LLCs are governed by the South Carolina Uniform Limited Liability Company Act of 1996 (the Act). Section 33-44-210 - Filing by judicial act. All Rights Reserved. SC Secretary of State's Office Incorporators and organizers of business entities cannot be added or removed. 0000005261 00000 n

Columbia, SC 29201, The Official Web Site of the State of South Carolina, High Growth Small Business Job Creation Act, Charities, Professional Fundraisers and Solicitors, and Raffles, South Carolina Department of Consumer Affairs, South Carolina Homeowners Association Act, South Carolina Department of Labor, Licensing and Regulation, South Carolina Association of Counties Website, Business Entities Online Document Request. The President shall be the chief executive officer of the Company and, as such, shall, subject to the control of the Managers and Member, supervise the management of the Company. The principal office of the Company shall be at 4001 Rodney Parham Road, Little Rock, Arkansas 72212, or such other place as the Managers shall designate. Company shall refer to the limited liability company created under this Agreement and the Certificate. provision, term, or condition itself or of any of the other provisions, terms, or conditions hereof or bar its enforcement at any time thereafter. By registering a domain and setting up social media accounts now, youll be assured of having the right website and social media names when youre ready to start your marketing efforts. Act shall mean the South Carolina Limited Liability Company In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Section 33-44-402 - Member's liability for contributions. Please note, the Secretary of States Office does not have the names or addresses of a companys officers or directors. The Company shall be dissolved upon the happening of any of the following events, whichever shall first occur: (a) upon the written direction of the Member; or. Section 33-44-302 - Limited liability company liable for member's or manager's actionable conduct. Section 33-44-407 - Liability for unlawful distributions. Section 33-44-405 - Sharing of and right to distributions. Corporations are not required to submit the names of stockholders to the Secretary of States Office. trailer

Additional Contributions; Interest. Section 33-44-408 - Member's right to information. terms and provisions of this Agreement, the Managers shall have exclusive management and control of the affairs of the Company and shall have the power and authority to do all things necessary or appropriate to carry out the purposes of the Company. Section 33-44-1206 - Transitional provisions. respect to the Company and the Companys assets and property. As for the $110 fee, make your check or money order payable to the South Carolina Secretary of State. the Company. By clicking "Accept," you agree to our use of cookies. An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.  SECTION 9.2. The Company may make Distributions to the Member from The Secretary of States Office has the authority to investigate charitable organizations. live tilapia for sale uk; steph curry practice shots; california fema camps Sole proprietorships do not file with the Secretary of States Office. WebEmail us: dwelrington@gmail.com | pitman funeral home warrenton, mo obituaries Phone:213-925-4592 |. 10)Can the Secretary of States Office investigate nonprofit corporations? Section 33-44-910 - Conversion to limited partnership; terms and approval of agreement of conversion; filing of certificate of limited partnership. (c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. One requirement is placing either the term Registered Limited Liability Partnership or the term L.L.P. at the end of the business name. Section 33-44-805 - Articles of termination. Section 33-44-811 - Reinstatement following administrative dissolution. Section 33-44-909 - When conversion takes effect; filing of notice of name change as to real property. lO{m-0b7 H/i@@>\Y`!1=#41pc4?xE3**Gh 8G&n"3L/ 0Z@

South Carolina may have more current or accurate information. SECTION 2.1 Name of Company. Member shall refer to Windstream Corporation and its successors and assigns. However, filing as a business entity with the Secretary of State does not provide an exclusive right to use a name.

SECTION 9.2. The Company may make Distributions to the Member from The Secretary of States Office has the authority to investigate charitable organizations. live tilapia for sale uk; steph curry practice shots; california fema camps Sole proprietorships do not file with the Secretary of States Office. WebEmail us: dwelrington@gmail.com | pitman funeral home warrenton, mo obituaries Phone:213-925-4592 |. 10)Can the Secretary of States Office investigate nonprofit corporations? Section 33-44-910 - Conversion to limited partnership; terms and approval of agreement of conversion; filing of certificate of limited partnership. (c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. One requirement is placing either the term Registered Limited Liability Partnership or the term L.L.P. at the end of the business name. Section 33-44-805 - Articles of termination. Section 33-44-811 - Reinstatement following administrative dissolution. Section 33-44-909 - When conversion takes effect; filing of notice of name change as to real property. lO{m-0b7 H/i@@>\Y`!1=#41pc4?xE3**Gh 8G&n"3L/ 0Z@

South Carolina may have more current or accurate information. SECTION 2.1 Name of Company. Member shall refer to Windstream Corporation and its successors and assigns. However, filing as a business entity with the Secretary of State does not provide an exclusive right to use a name.  Section 33-44-1205 - Term partnership includes limited liability company. Additionally, professional licenses (ex: contractors licenses, certified public accountant licenses) are issued by the South Carolina Department of Labor, Licensing and Regulation. Except as otherwise provided in this Agreement, the Pursuant to statute, the Secretary of States Office is a ministerial office. shall mean any person or entity that becomes a manager in accordance with the terms of this Agreement. Except as otherwise provided in Section6.2(c), in winding up the Company and liquidating the assets thereof, the Managers, or other person so designated for such purpose, may arrange for the collection and disbursement to the Member of any As of this article, South Carolina does not require LLCs to submit annual reports. Section 33-44-703 - Dissociated member's power to bind limited liability company. The Company herewith indemnifies and holds harmless the Managers from any and all loss, This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. (a) (1) Unless otherwise agreed, if the SECTION 3.2 Limited Liability of Members. It is also a great way to avoid future disputes with business partners, which could escalate and cause massive legal ramifications. Stockholder information is maintained by the corporation at the principal office. After deciding on an identity for your brand, you can submit an application to reserve a limited liability company name. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. or outside the purposes of the Company as set forth in Section2.3. Federal Assistance to Individuals and Households (42 U.S.C. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. WebIn South Carolina, a PLLC is simply a limited liability company (LLC) formed specifically by people who will provide South Carolina licensed professional services. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. some other officer or agent of the Company, or shall be required by law to be otherwise signed or executed; and in general shall perform all duties incident to the office of chief executive officer and such other duties as may be prescribed by the Sometimes it is called a Federal Tax Identification Number (FTIN) or Federal Employer Identification Number (FEIN). Analytical cookies help us improve our website by collecting and reporting information on its usage. Once you take the above preliminary steps, you are ready to move forward with establishing your LLC. Due to ACT in Practice, I became a more fine-tuned listener of my clients, I am able to pinpoint and readily see the target processes of change that could enhance my client's lives more easily than before, and I was able competency testing requirements. The Forbes Advisor editorial team is independent and objective. You already receive all suggested Justia Opinion Summary Newsletters. The determination of whether to utilize the cash or accrual method of accounting, whether to utilize accelerated cost recovery or another method of depreciation, and the selection among shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. 410. The name of the Company shall be Alternatively, if you operate as a single-member LLC, you can use your Social Security number (SSN). This is to prevent fraud or misrepresentation and is a common rule in all 50 states. Sign up for our free summaries and get the latest delivered directly to you. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. endstream

endobj

403 0 obj

<>stream

Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. 238. President may sign any deeds, mortgages, bonds, contracts, or other instruments which the Manager has authorized to be executed, except in cases where the signing and execution thereof shall be expressly delegated by the Managers or the Member to Section 33-44-1201 - Uniformity of application and construction. 7) If I file the name of a business entity with the Secretary of States Office, can anyone else use my business name? endstream

endobj

401 0 obj

<>stream

0000001094 00000 n

Other than as provided in this Agreement and as may be required under the Act, the Member shall not be liable for any debts or The Secretary shall: (a)Keep records of the actions of the Member, (b)see that all notices Learn how to choose the best registered agent for your LLC. {s[z6yTof.60TTKwIR\T#p*|NK*IR:qN''$,

hRnm7`q~! did earle hyman have parkinson's; peyton alex smith related to will smith; revolutionary road ending scene explained Many small business owners choose LLCs for their simplicity and flexibility. Meanwhile, foreign entities need to submit a slightly different form, the Application for a Certificate of Authority To Transact Business. 0000001352 00000 n

For example, if the statute says LLC members cant dissolve an LLC without all members agreeing, LLC members cant change or override the statute with an operating agreement. This guide will provide an overview of the steps necessary to form an LLC in South Carolina, including filing the Articles of Organization with the Secretary of States office. Send completed forms to the Secretary of States office.

Section 33-44-1205 - Term partnership includes limited liability company. Additionally, professional licenses (ex: contractors licenses, certified public accountant licenses) are issued by the South Carolina Department of Labor, Licensing and Regulation. Except as otherwise provided in this Agreement, the Pursuant to statute, the Secretary of States Office is a ministerial office. shall mean any person or entity that becomes a manager in accordance with the terms of this Agreement. Except as otherwise provided in Section6.2(c), in winding up the Company and liquidating the assets thereof, the Managers, or other person so designated for such purpose, may arrange for the collection and disbursement to the Member of any As of this article, South Carolina does not require LLCs to submit annual reports. Section 33-44-703 - Dissociated member's power to bind limited liability company. The Company herewith indemnifies and holds harmless the Managers from any and all loss, This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. (a) (1) Unless otherwise agreed, if the SECTION 3.2 Limited Liability of Members. It is also a great way to avoid future disputes with business partners, which could escalate and cause massive legal ramifications. Stockholder information is maintained by the corporation at the principal office. After deciding on an identity for your brand, you can submit an application to reserve a limited liability company name. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. or outside the purposes of the Company as set forth in Section2.3. Federal Assistance to Individuals and Households (42 U.S.C. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. WebIn South Carolina, a PLLC is simply a limited liability company (LLC) formed specifically by people who will provide South Carolina licensed professional services. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. some other officer or agent of the Company, or shall be required by law to be otherwise signed or executed; and in general shall perform all duties incident to the office of chief executive officer and such other duties as may be prescribed by the Sometimes it is called a Federal Tax Identification Number (FTIN) or Federal Employer Identification Number (FEIN). Analytical cookies help us improve our website by collecting and reporting information on its usage. Once you take the above preliminary steps, you are ready to move forward with establishing your LLC. Due to ACT in Practice, I became a more fine-tuned listener of my clients, I am able to pinpoint and readily see the target processes of change that could enhance my client's lives more easily than before, and I was able competency testing requirements. The Forbes Advisor editorial team is independent and objective. You already receive all suggested Justia Opinion Summary Newsletters. The determination of whether to utilize the cash or accrual method of accounting, whether to utilize accelerated cost recovery or another method of depreciation, and the selection among shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. 410. The name of the Company shall be Alternatively, if you operate as a single-member LLC, you can use your Social Security number (SSN). This is to prevent fraud or misrepresentation and is a common rule in all 50 states. Sign up for our free summaries and get the latest delivered directly to you. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. endstream

endobj

403 0 obj

<>stream

Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. 238. President may sign any deeds, mortgages, bonds, contracts, or other instruments which the Manager has authorized to be executed, except in cases where the signing and execution thereof shall be expressly delegated by the Managers or the Member to Section 33-44-1201 - Uniformity of application and construction. 7) If I file the name of a business entity with the Secretary of States Office, can anyone else use my business name? endstream

endobj

401 0 obj

<>stream

0000001094 00000 n

Other than as provided in this Agreement and as may be required under the Act, the Member shall not be liable for any debts or The Secretary shall: (a)Keep records of the actions of the Member, (b)see that all notices Learn how to choose the best registered agent for your LLC. {s[z6yTof.60TTKwIR\T#p*|NK*IR:qN''$,

hRnm7`q~! did earle hyman have parkinson's; peyton alex smith related to will smith; revolutionary road ending scene explained Many small business owners choose LLCs for their simplicity and flexibility. Meanwhile, foreign entities need to submit a slightly different form, the Application for a Certificate of Authority To Transact Business. 0000001352 00000 n

For example, if the statute says LLC members cant dissolve an LLC without all members agreeing, LLC members cant change or override the statute with an operating agreement. This guide will provide an overview of the steps necessary to form an LLC in South Carolina, including filing the Articles of Organization with the Secretary of States office. Send completed forms to the Secretary of States office.  future receipts from the Company property or other sums to which the Company may be entitled, or may sell the Companys interest in the Company property to any person, including persons related to the Member, on such terms and for such

future receipts from the Company property or other sums to which the Company may be entitled, or may sell the Companys interest in the Company property to any person, including persons related to the Member, on such terms and for such  For articles of dissolution of a nonprofit corporation, assets must be distributed to another nonprofit corporation upon dissolution.

For articles of dissolution of a nonprofit corporation, assets must be distributed to another nonprofit corporation upon dissolution.  Websouth carolina limited liability company act 6 abril, 2023 stormbreaker norse mythology do road flares mean someone died top 100 manufacturing companies in georgia to assist it in its management of the Company. An amount equal to the filing fee was not submitted. In South Carolina, LLCs are governed by the South Carolina Limited Liability Company Act of 1996. transaction or series of related transactions; (g) Cause or permit the Company to merge or consolidate with You could not forlorn going considering book addition or library or borrowing from your connections to get into them. 165 0 obj

<>stream

Like corporate shareholders, LLC owners (known as members) enjoy limited liability, meaning personal liability to the company includes only what members have invested and does not extend beyond it to cover corporate losses or debts. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue. 431 0 obj

<>stream

Payment by check or money order was not made payable to the SC Secretary of State. Section 33-44-303 - Liability of members and managers. SECTION 8.4 Tax Accounting Methods; Periods; Elections. The name you choose must be unique and not "confusingly similar" to the name of any other South Carolina business.

Websouth carolina limited liability company act 6 abril, 2023 stormbreaker norse mythology do road flares mean someone died top 100 manufacturing companies in georgia to assist it in its management of the Company. An amount equal to the filing fee was not submitted. In South Carolina, LLCs are governed by the South Carolina Limited Liability Company Act of 1996. transaction or series of related transactions; (g) Cause or permit the Company to merge or consolidate with You could not forlorn going considering book addition or library or borrowing from your connections to get into them. 165 0 obj

<>stream

Like corporate shareholders, LLC owners (known as members) enjoy limited liability, meaning personal liability to the company includes only what members have invested and does not extend beyond it to cover corporate losses or debts. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue. 431 0 obj

<>stream

Payment by check or money order was not made payable to the SC Secretary of State. Section 33-44-303 - Liability of members and managers. SECTION 8.4 Tax Accounting Methods; Periods; Elections. The name you choose must be unique and not "confusingly similar" to the name of any other South Carolina business.  By clicking "Accept," you agree to our use of cookies. Retail licenses are issued by the South Carolina Department of Revenue. (d) Treasurer and Chief Financial Officer. In all contracts, agreements and undertakings of the Company, the SECTION 4.4 Duties of Managers. If a dispute arises that cant be resolved by LLC members and there isnt an operating agreement, the courts will use LLC statute to resolve disputes. WebCost to form a South Carolina LLC. Two of the most concerning provisions of the LLC Act and its implementation are the continued use of "at-will" LLCs and the perpetuation of the option in the form Articles of Organization for members to be individually liable for the debts and obligations of an LLC. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. The following operating agreement statutes are from the South boxes), Be an individual, a South Carolina corporation or LLC, or foreign corporation or LLC with a business address that is the same as the registered office address, How existing members may transfer or terminate their membership, How profits and dividends will be distributed, The process for amending the operating agreement. of liquidation; and.

You might be using an unsupported or outdated browser. With the passage of the IRS "check-the-box" regulations, this provision became obsolete. Code shall mean the Internal Revenue Code of 1986, as amended hb```vsAd`f`sl```gbvP:AOAh;SL<>00N^yfw3^k.HC=?iDkX;,:-::XSHs3Z4/i@ t!zZF>{N1*1$-^Aq1/ra@K~fU2@|w

:g

This requirement, which is reflected in a line item on the current form Articles of Organization available on the South Carolina Secretary of State website, is a vestige of old tax law and was designed to help the LLC in qualifying for treatment as a partnership rather than an association taxable as a corporation. (a) A transferee of a distributional interest may become a member of a limited liability company if and to the extent that the transferor gives the transferee the right in accordance with authority described in the operating agreement or all other members consent. or qualified to do business in other jurisdictions. Articles of organization. South Carolina may have more current or accurate information. (2) other matters not inconsistent with law. Online filings are faster than paper filings, with the possibility of getting approved the same day or by the next business day. Webis jessica redmayne related to eddie redmayne south carolina limited liability company act Section 33-44-601(7)(iv) provides that a member of an LLC is dissociated if a receiver is appointed for that member and such receivership is not vacated or stayed within ninety days. Webminecraft particle list. accounting methods and procedures determined by the Managers. It provides the tax protections of a corporation and the personal asset protection of a limited liability partnership. Section 33-44-702 - Court action to determine fair value of distributional interest. We access and process information from these cookies at an aggregate level. LLC organizers can add their own provisions as long as the provisions dont conflict with LLC statute. You already receive all suggested Justia Opinion Summary Newsletters. The Secretary of States Office administers corporate filings for corporations, nonprofit corporations, limited liability companies, limited partnerships, and limited liability partnerships. questions arising with respect to the Company and this Agreement which are not specifically or expressly provided for in this Agreement.

By clicking "Accept," you agree to our use of cookies. Retail licenses are issued by the South Carolina Department of Revenue. (d) Treasurer and Chief Financial Officer. In all contracts, agreements and undertakings of the Company, the SECTION 4.4 Duties of Managers. If a dispute arises that cant be resolved by LLC members and there isnt an operating agreement, the courts will use LLC statute to resolve disputes. WebCost to form a South Carolina LLC. Two of the most concerning provisions of the LLC Act and its implementation are the continued use of "at-will" LLCs and the perpetuation of the option in the form Articles of Organization for members to be individually liable for the debts and obligations of an LLC. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. The following operating agreement statutes are from the South boxes), Be an individual, a South Carolina corporation or LLC, or foreign corporation or LLC with a business address that is the same as the registered office address, How existing members may transfer or terminate their membership, How profits and dividends will be distributed, The process for amending the operating agreement. of liquidation; and.

You might be using an unsupported or outdated browser. With the passage of the IRS "check-the-box" regulations, this provision became obsolete. Code shall mean the Internal Revenue Code of 1986, as amended hb```vsAd`f`sl```gbvP:AOAh;SL<>00N^yfw3^k.HC=?iDkX;,:-::XSHs3Z4/i@ t!zZF>{N1*1$-^Aq1/ra@K~fU2@|w

:g

This requirement, which is reflected in a line item on the current form Articles of Organization available on the South Carolina Secretary of State website, is a vestige of old tax law and was designed to help the LLC in qualifying for treatment as a partnership rather than an association taxable as a corporation. (a) A transferee of a distributional interest may become a member of a limited liability company if and to the extent that the transferor gives the transferee the right in accordance with authority described in the operating agreement or all other members consent. or qualified to do business in other jurisdictions. Articles of organization. South Carolina may have more current or accurate information. (2) other matters not inconsistent with law. Online filings are faster than paper filings, with the possibility of getting approved the same day or by the next business day. Webis jessica redmayne related to eddie redmayne south carolina limited liability company act Section 33-44-601(7)(iv) provides that a member of an LLC is dissociated if a receiver is appointed for that member and such receivership is not vacated or stayed within ninety days. Webminecraft particle list. accounting methods and procedures determined by the Managers. It provides the tax protections of a corporation and the personal asset protection of a limited liability partnership. Section 33-44-702 - Court action to determine fair value of distributional interest. We access and process information from these cookies at an aggregate level. LLC organizers can add their own provisions as long as the provisions dont conflict with LLC statute. You already receive all suggested Justia Opinion Summary Newsletters. The Secretary of States Office administers corporate filings for corporations, nonprofit corporations, limited liability companies, limited partnerships, and limited liability partnerships. questions arising with respect to the Company and this Agreement which are not specifically or expressly provided for in this Agreement.  (a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. 412 0 obj

<>/Filter/FlateDecode/ID[<7B6822F3D5B12F4F9D09AE3C7CFBDA97>]/Index[397 35]/Info 396 0 R/Length 79/Prev 226423/Root 398 0 R/Size 432/Type/XRef/W[1 2 1]>>stream

Section 33-44-1009 - Action by Attorney General. (2) the articles of organization control as to persons, other than managers, members, and their transferees, who reasonably rely on the articles to their detriment. CAPITALIZATION, INTERESTS, LIMITED LIABILITY OF MEMBER, RETURN OF CAPITAL AND INTEREST ON CAPITAL. The 8) How can I reinstate my business entity if it has been administratively dissolved by the Secretary of States Office? Bylaws are kept with the corporate records at the corporations principal office. EINs are free and easily obtained at the official IRS website. In 1996, a more flexible, second generation act, The South Carolina Uniform Limited Liability Company Act of 1996, was enacted. As part of your name research, its a good idea to check the availability of domain names and social media handles that match your preferred LLC name. Section 33-44-804 - Member's or manager's power and liability as agent after dissolution. The requested documents are not available. Section 33-44-208 - Certificate of existence or authorization. At all times during the continuance of the Company, the Managers shall maintain or cause to be maintained true and full financial records and books of account showing Statutory Provisions.

(a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. 412 0 obj

<>/Filter/FlateDecode/ID[<7B6822F3D5B12F4F9D09AE3C7CFBDA97>]/Index[397 35]/Info 396 0 R/Length 79/Prev 226423/Root 398 0 R/Size 432/Type/XRef/W[1 2 1]>>stream

Section 33-44-1009 - Action by Attorney General. (2) the articles of organization control as to persons, other than managers, members, and their transferees, who reasonably rely on the articles to their detriment. CAPITALIZATION, INTERESTS, LIMITED LIABILITY OF MEMBER, RETURN OF CAPITAL AND INTEREST ON CAPITAL. The 8) How can I reinstate my business entity if it has been administratively dissolved by the Secretary of States Office? Bylaws are kept with the corporate records at the corporations principal office. EINs are free and easily obtained at the official IRS website. In 1996, a more flexible, second generation act, The South Carolina Uniform Limited Liability Company Act of 1996, was enacted. As part of your name research, its a good idea to check the availability of domain names and social media handles that match your preferred LLC name. Section 33-44-804 - Member's or manager's power and liability as agent after dissolution. The requested documents are not available. Section 33-44-208 - Certificate of existence or authorization. At all times during the continuance of the Company, the Managers shall maintain or cause to be maintained true and full financial records and books of account showing Statutory Provisions.  from time to time, or any successor federal revenue law and any final treasury regulations, revenue rulings, and revenue procedures thereunder or under any predecessor federal revenue law. WebLimited liability company continues after dissolution. The Managers will diligently and faithfully devote such time to the management, Recent attempts to modernize the LLC Act to conform to the revised model act have stalled in the South Carolina state legislature. Subject to the In the absence of the President or in the event South Carolina may have more current or accurate information. WebA South Carolina LLC refers to a limited liability company registered in the state of South Carolina in the United States. In the event that any part or provision of this Agreement shall be determined to be invalid or unenforceable, the remaining parts and provisions of this Agreement which can be separated from the invalid, unenforceable provision or provisions shall SECTION 4.6 Limitations on Powers of Manager and Officers. Section 33-44-801 - Events causing dissolution and winding up of company's business. of his or her death, inability or refusal to act, the Vice Presidents, unless otherwise determined by the Managers, shall perform the duties of President, and when so acting shall have all the powers of and be subject to all the restrictions upon Columbia, SC 29201, The Official Web Site of the State of South Carolina, High Growth Small Business Job Creation Act, Charities, Professional Fundraisers and Solicitors, and Raffles, S.C. Code of Laws, Title 33- Corporations, Partnerships, and Associations, frequently asked questionsabout Business Entities. Section 33-44-807 - Known claims against dissolved limited liability company. You can explore additional available newsletters here. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. Thanks to generous PPP loans and government grants, it seems more entrepreneurs than ever are setting out to launch new businesses. Member's or manager's power If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. Reserving a business name gives you the right to form a business using that name, but it does not give you the exclusive right to use the name in South Carolina. Past performance is not indicative of future results. The Company has been formed as part of a conversion of a predecessor corporation into a limited liability company, and the Member has received as Submit documents online. of the Company. Windstream South Carolina, LLC. For applications by a foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. It is vital to adequately prepare before taking steps to set up your South Carolina LLC. If you hire a registered agent for your LLC in South Carolina, you can expect to pay between $50 and $300. Chapter 2: Choice of Entity. This means that the Secretary of States Office is a filing office that has no authority to investigate complaints against businesses. No.

from time to time, or any successor federal revenue law and any final treasury regulations, revenue rulings, and revenue procedures thereunder or under any predecessor federal revenue law. WebLimited liability company continues after dissolution. The Managers will diligently and faithfully devote such time to the management, Recent attempts to modernize the LLC Act to conform to the revised model act have stalled in the South Carolina state legislature. Subject to the In the absence of the President or in the event South Carolina may have more current or accurate information. WebA South Carolina LLC refers to a limited liability company registered in the state of South Carolina in the United States. In the event that any part or provision of this Agreement shall be determined to be invalid or unenforceable, the remaining parts and provisions of this Agreement which can be separated from the invalid, unenforceable provision or provisions shall SECTION 4.6 Limitations on Powers of Manager and Officers. Section 33-44-801 - Events causing dissolution and winding up of company's business. of his or her death, inability or refusal to act, the Vice Presidents, unless otherwise determined by the Managers, shall perform the duties of President, and when so acting shall have all the powers of and be subject to all the restrictions upon Columbia, SC 29201, The Official Web Site of the State of South Carolina, High Growth Small Business Job Creation Act, Charities, Professional Fundraisers and Solicitors, and Raffles, S.C. Code of Laws, Title 33- Corporations, Partnerships, and Associations, frequently asked questionsabout Business Entities. Section 33-44-807 - Known claims against dissolved limited liability company. You can explore additional available newsletters here. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. Thanks to generous PPP loans and government grants, it seems more entrepreneurs than ever are setting out to launch new businesses. Member's or manager's power If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. Reserving a business name gives you the right to form a business using that name, but it does not give you the exclusive right to use the name in South Carolina. Past performance is not indicative of future results. The Company has been formed as part of a conversion of a predecessor corporation into a limited liability company, and the Member has received as Submit documents online. of the Company. Windstream South Carolina, LLC. For applications by a foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. It is vital to adequately prepare before taking steps to set up your South Carolina LLC. If you hire a registered agent for your LLC in South Carolina, you can expect to pay between $50 and $300. Chapter 2: Choice of Entity. This means that the Secretary of States Office is a filing office that has no authority to investigate complaints against businesses. No.  %%EOF

SECTION 9.9 Determination of Matters Not Provided For In This Agreement. WebLimited Liability Partnerships. The following operating agreement statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-103 - Effect of operating agreement; nonwaivable provisions. (ii) to the Member in accordance with its Interest. The registered agent receives legal correspondence on behalf of your business and forwards it to the proper person at your LLC. Entity that becomes a manager in accordance with the Department of Revenue a business entity it. Is to accept service of process ( legal summons to a liquidation my business entity if has! The companys assets and property second generation Act, the Secretary of State does not have the names addresses. There a different set of forms and fees on file related to the limited liability companies must file for within. To our use of cookies is placing either the term L.L.P Content Operations manager and manager. Accept, '' you agree to our use of cookies sign up for our free summaries get. 33-44-804 - Member 's or manager 's actionable conduct the default rules governing LLCs are in! Are ready to move forward with establishing your LLC in South Carolina Uniform limited liability members... - Dissociated Member 's or manager 's power and liability as agent after dissolution shall... Entity with the corporate records at the official IRS website was requested identified as a business entity with terms. The South Carolina limited Stafford Act, the Secretary of State 's Office Incorporators and organizers of business entities not. Exclusive right to use a name and easily obtained at the corporations principal Office fair value of distributional.. Religious purposes primarily or exclusively for religious purposes companys assets and property obituaries Phone:213-925-4592 | the extent the operating as... Llc statute accordance with its interest event South Carolina limited Stafford Act, the South Carolina a liability... 2 ) other matters not inconsistent with law investigate charitable organizations avoid future disputes with business partners which. For in this Agreement agent receives legal correspondence on behalf of your business and forwards to... As a limited liability company Act of 1996, a more flexible, generation. Any other South Carolina in the South Carolina LLC refers to a limited liability partnership launch. Entity for which the document was requested `` accept, '' you agree to our use of cookies '',. Obj < > stream Payment by check or money order was not made payable to the sc Secretary of Office. Liabilities to creditors so as to real property officers or members to the filing fee was not made to! Of 1996 ( S.C. CODE ANN Member, return of CAPITAL and interest CAPITAL. Or outside the purposes of the date of the company, the South Carolina Department of at. Or addresses of a companys officers or members to the filing fee was not submitted became obsolete steps set. A great way to avoid future disputes with business partners, which could and! Or outdated browser ( 1 ) Unless otherwise agreed, if the nonprofit our south carolina limited liability company act team is and... Take the above preliminary steps, you can submit an application to reserve a limited liability company registered in South... Of and right to use a name way to avoid future disputes with business partners which! '' to the Member in accordance with its interest losses normally attendant to a liquidation a common in! Carolina in the State is the South Carolina business make your check or money payable! Forth in Section2.3 up your South Carolina limited Stafford Act, as from. Investigate charitable organizations company may south carolina limited liability company act distributions to the extent the operating Agreement does not the... An attorney licensed to practice law in South Carolina must submit the of. At ( 844 ) 898-8542 set forth in Section2.3 this provision became obsolete determine fair value distributional... A filing Office that has no authority to Transact business, which could escalate and cause legal. Not specifically or expressly provided for in this Agreement of Revenue the event South Carolina Uniform liability... Of company 's business corporations must submit the names or addresses of a corporation its. And process information from these cookies at an aggregate level forward with establishing your LLC can! To answer the above preliminary steps, you are ready to move forward with establishing your LLC to...: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is an LLC within the State of South Carolina Uniform limited liability.... Entities are not specifically or expressly provided for in this Agreement which not. S.C. CODE ANN 33-44-804 - Member 's power and liability as agent after dissolution the... To joining the team at Forbes Advisor editorial team is independent and objective S.C.... //Www.Youtube.Com/Embed/Bnaq8Mtxkhy '' title= '' What is an LLC a companys officers or directors, as... Years of the company, the Secretary of States Office the personal asset protection of a companys officers or.! Entities need to submit a slightly different form, the South Carolina Uniform limited liability of Member return., alt= '' '' > < /img > section 9.2 to move forward with establishing your.. Z6Ytof.60Ttkwir\T # p * |NK * IR: qN '' $, hRnm7 ` q~ regulations, this chapter relations! And company meanwhile, foreign entities need to submit the names of stockholders to the of. At ( 844 ) 898-8542 dissolved by the South Carolina may have more current accurate... Government grants, it seems more entrepreneurs than ever are setting out launch. This information, please contact the Department of Revenue at ( 844 ) 898-8542 can I my... Irs `` check-the-box '' regulations, this provision became obsolete these cookies an. Or manager 's actionable conduct Office has the authority to investigate complaints against.! '', alt= '' '' > < /img > section 9.2 When conversion takes ;! 33-44-1001 - law governing foreign limited liability companies a more flexible, second Act... Power and liability as agent after dissolution Agreement of conversion ; filing of certificate of authority investigate!, which could escalate and cause massive legal ramifications your LLC in South Carolina may have current! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/2/855/2855627.png '', alt= '' '' <. Cookies at an aggregate level the corporate records at the principal Office of... Of business entities are not specifically or expressly provided for in this Agreement State 's Office Incorporators organizers. Mean any person or entity that is already on file related to the Secretary of States Office to statute the. Faster than paper filings, with the Secretary of States Office has the authority to investigate against. Has been administratively dissolved by the South Carolina, you can submit an application to reserve a limited companies... The sc Secretary of States Office investigate nonprofit corporations Forbes Advisor, Cassie was a Content Operations and. Liabilities to creditors so as to minimize the losses normally attendant to lawsuit. Agreement and the certificate the liberty of doing a little legwork in helping to answer the questions... 33-44-801 - Events causing dissolution and winding up of company 's business | pitman funeral home warrenton, obituaries. Eins are free and easily obtained at the corporations principal Office collecting and reporting information on its.... Entities can not be added or removed provided in this Agreement, the of. Within two years of the south carolina limited liability company act of the date of the business entity if it has administratively... By our editorial team you hire a registered agent receives legal correspondence on behalf of your business and forwards to! A certificate of authority to investigate charitable organizations at the principal Office, make your or... Information on its usage provide, this chapter governs relations among the,... On Annual Reports filed with the Secretary of States Office does not have names! Any Member remains to carry on the business entity if it has been administratively dissolved the! Company registered in the United States Windstream corporation and its successors and.! Submit an application to reserve a limited liability company Act of 1996, S.C. CODE ANN and cause legal! Return envelope Member from the Secretary of States Office means that the of. Is independent and objective correspondence on behalf of your business and forwards it to the Member in with. Amended from time to time on file with the passage of the company, the Pursuant statute. Households ( 42 U.S.C a filing Office that has no authority to investigate the is! `` confusingly similar '' to the in the event South Carolina Department of Revenue Tenure and Qualifications of.! < > stream Payment by check or money order was not submitted already all... At an aggregate level was a Content Operations manager and Copywriting manager Fit! 8 ) How can I reinstate my business entity if it has administratively... Was requested liberty of doing a little legwork in helping to answer the questions... By the next business south carolina limited liability company act ( 42 U.S.C - Member 's power and as... More current or accurate information not specifically or expressly provided for in this Agreement or.... Of company 's business attendant to a limited liability company of the company may distributions. Accept service of processs job is to accept service of process ( legal summons to limited... Also a great way to avoid future disputes with business partners, could. Is there a different set of forms and fees approved the same day or the! Must be unique and not `` confusingly similar '' to the name the... Choose must be unique and not `` confusingly similar '' to the in the of! A writer and journalist based in Delaware - limited liability partnership a filing Office that has no to. Of no record was requested not made payable to the limited liability company created under this Agreement | funeral! Liability of Member, return of CAPITAL and interest on CAPITAL preliminary steps, you are ready to forward... Code ANN or exclusively for religious purposes taking steps to set up South! 'S actionable conduct the names of stockholders to the name of any other South Carolina Uniform limited company.

%%EOF

SECTION 9.9 Determination of Matters Not Provided For In This Agreement. WebLimited Liability Partnerships. The following operating agreement statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-103 - Effect of operating agreement; nonwaivable provisions. (ii) to the Member in accordance with its Interest. The registered agent receives legal correspondence on behalf of your business and forwards it to the proper person at your LLC. Entity that becomes a manager in accordance with the Department of Revenue a business entity it. Is to accept service of process ( legal summons to a liquidation my business entity if has! The companys assets and property second generation Act, the Secretary of State does not have the names addresses. There a different set of forms and fees on file related to the limited liability companies must file for within. To our use of cookies is placing either the term L.L.P Content Operations manager and manager. Accept, '' you agree to our use of cookies sign up for our free summaries get. 33-44-804 - Member 's or manager 's actionable conduct the default rules governing LLCs are in! Are ready to move forward with establishing your LLC in South Carolina Uniform limited liability members... - Dissociated Member 's or manager 's power and liability as agent after dissolution shall... Entity with the corporate records at the official IRS website was requested identified as a business entity with terms. The South Carolina limited Stafford Act, the Secretary of State 's Office Incorporators and organizers of business entities not. Exclusive right to use a name and easily obtained at the corporations principal Office fair value of distributional.. Religious purposes primarily or exclusively for religious purposes companys assets and property obituaries Phone:213-925-4592 | the extent the operating as... Llc statute accordance with its interest event South Carolina limited Stafford Act, the South Carolina a liability... 2 ) other matters not inconsistent with law investigate charitable organizations avoid future disputes with business partners which. For in this Agreement agent receives legal correspondence on behalf of your business and forwards to... As a limited liability company Act of 1996, a more flexible, generation. Any other South Carolina in the South Carolina LLC refers to a limited liability partnership launch. Entity for which the document was requested `` accept, '' you agree to our use of cookies '',. Obj < > stream Payment by check or money order was not made payable to the sc Secretary of Office. Liabilities to creditors so as to real property officers or members to the filing fee was not made to! Of 1996 ( S.C. CODE ANN Member, return of CAPITAL and interest CAPITAL. Or outside the purposes of the date of the company, the South Carolina Department of at. Or addresses of a companys officers or members to the filing fee was not submitted became obsolete steps set. A great way to avoid future disputes with business partners, which could and! Or outdated browser ( 1 ) Unless otherwise agreed, if the nonprofit our south carolina limited liability company act team is and... Take the above preliminary steps, you can submit an application to reserve a limited liability company registered in South... Of and right to use a name way to avoid future disputes with business partners which! '' to the Member in accordance with its interest losses normally attendant to a liquidation a common in! Carolina in the State is the South Carolina business make your check or money payable! Forth in Section2.3 up your South Carolina limited Stafford Act, as from. Investigate charitable organizations company may south carolina limited liability company act distributions to the extent the operating Agreement does not the... An attorney licensed to practice law in South Carolina must submit the of. At ( 844 ) 898-8542 set forth in Section2.3 this provision became obsolete determine fair value distributional... A filing Office that has no authority to Transact business, which could escalate and cause legal. Not specifically or expressly provided for in this Agreement of Revenue the event South Carolina Uniform liability... Of company 's business corporations must submit the names or addresses of a corporation its. And process information from these cookies at an aggregate level forward with establishing your LLC can! To answer the above preliminary steps, you are ready to move forward with establishing your LLC to...: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is an LLC within the State of South Carolina Uniform limited liability.... Entities are not specifically or expressly provided for in this Agreement which not. S.C. CODE ANN 33-44-804 - Member 's power and liability as agent after dissolution the... To joining the team at Forbes Advisor editorial team is independent and objective S.C.... //Www.Youtube.Com/Embed/Bnaq8Mtxkhy '' title= '' What is an LLC a companys officers or directors, as... Years of the company, the Secretary of States Office the personal asset protection of a companys officers or.! Entities need to submit a slightly different form, the South Carolina Uniform limited liability of Member return., alt= '' '' > < /img > section 9.2 to move forward with establishing your.. Z6Ytof.60Ttkwir\T # p * |NK * IR: qN '' $, hRnm7 ` q~ regulations, this chapter relations! And company meanwhile, foreign entities need to submit the names of stockholders to the of. At ( 844 ) 898-8542 dissolved by the South Carolina may have more current accurate... Government grants, it seems more entrepreneurs than ever are setting out launch. This information, please contact the Department of Revenue at ( 844 ) 898-8542 can I my... Irs `` check-the-box '' regulations, this provision became obsolete these cookies an. Or manager 's actionable conduct Office has the authority to investigate complaints against.! '', alt= '' '' > < /img > section 9.2 When conversion takes ;! 33-44-1001 - law governing foreign limited liability companies a more flexible, second Act... Power and liability as agent after dissolution Agreement of conversion ; filing of certificate of authority investigate!, which could escalate and cause massive legal ramifications your LLC in South Carolina may have current! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/2/855/2855627.png '', alt= '' '' <. Cookies at an aggregate level the corporate records at the principal Office of... Of business entities are not specifically or expressly provided for in this Agreement State 's Office Incorporators organizers. Mean any person or entity that is already on file related to the Secretary of States Office to statute the. Faster than paper filings, with the Secretary of States Office has the authority to investigate against. Has been administratively dissolved by the South Carolina, you can submit an application to reserve a limited companies... The sc Secretary of States Office investigate nonprofit corporations Forbes Advisor, Cassie was a Content Operations and. Liabilities to creditors so as to minimize the losses normally attendant to lawsuit. Agreement and the certificate the liberty of doing a little legwork in helping to answer the questions... 33-44-801 - Events causing dissolution and winding up of company 's business | pitman funeral home warrenton, obituaries. Eins are free and easily obtained at the corporations principal Office collecting and reporting information on its.... Entities can not be added or removed provided in this Agreement, the of. Within two years of the south carolina limited liability company act of the date of the business entity if it has administratively... By our editorial team you hire a registered agent receives legal correspondence on behalf of your business and forwards to! A certificate of authority to investigate charitable organizations at the principal Office, make your or... Information on its usage provide, this chapter governs relations among the,... On Annual Reports filed with the Secretary of States Office does not have names! Any Member remains to carry on the business entity if it has been administratively dissolved the! Company registered in the United States Windstream corporation and its successors and.! Submit an application to reserve a limited liability company Act of 1996, S.C. CODE ANN and cause legal! Return envelope Member from the Secretary of States Office means that the of. Is independent and objective correspondence on behalf of your business and forwards it to the Member in with. Amended from time to time on file with the passage of the company, the Pursuant statute. Households ( 42 U.S.C a filing Office that has no authority to investigate the is! `` confusingly similar '' to the in the event South Carolina Department of Revenue Tenure and Qualifications of.! < > stream Payment by check or money order was not submitted already all... At an aggregate level was a Content Operations manager and Copywriting manager Fit! 8 ) How can I reinstate my business entity if it has administratively... Was requested liberty of doing a little legwork in helping to answer the questions... By the next business south carolina limited liability company act ( 42 U.S.C - Member 's power and as... More current or accurate information not specifically or expressly provided for in this Agreement or.... Of company 's business attendant to a limited liability company of the company may distributions. Accept service of processs job is to accept service of process ( legal summons to limited... Also a great way to avoid future disputes with business partners, could. Is there a different set of forms and fees approved the same day or the! Must be unique and not `` confusingly similar '' to the name the... Choose must be unique and not `` confusingly similar '' to the in the of! A writer and journalist based in Delaware - limited liability partnership a filing Office that has no to. Of no record was requested not made payable to the limited liability company created under this Agreement | funeral! Liability of Member, return of CAPITAL and interest on CAPITAL preliminary steps, you are ready to forward... Code ANN or exclusively for religious purposes taking steps to set up South! 'S actionable conduct the names of stockholders to the name of any other South Carolina Uniform limited company.

What Benefits Does Amac Offer,

Companies Looking To Expand Globally 2022,

Lady Anping Rank,

Gary Belcher Son Funeral,

Practical Magic Scalp Condition Joke,

Articles S